library(midasr)

library(quantmod)

library(lubridate)

usqgdp <- getSymbols("GDP",src="FRED",auto.assign=FALSE)

infl <- getSymbols("CPALTT01USM659N",src="FRED",auto.assign=FALSE)

usqgdp <- usqgdp["/2022-04-01",]

infl <- infl["/2022-06-01"]

gdpg <- diff(log(usqgdp))*100Reverse MIDAS with midasr

Introduction

This document presents example of fitting RU-MIDAS and RR-MIDAS models as described in Xu et al (2018) and Foroni et al (2018) using midasr R package. The source code for this document can be found in this repository.

The RU-MIDAS and RR-MIDAS models are used to forecast high frequency variable using low frequency variable. Suppose \(y_t\), \(t\in \mathbb{Z}\) is a univariate process observed at low frequency. Suppose \(x_\tau\), \(\tau=0,..,\) is a high frequency variable, i.e. for each low frequency period \(t=t_0\) we observe the variable \(x_\tau\) is observed at \(m\) high frequency periods: \(\tau = (t_0-1)m+1, ..., t_0m\).

The model specification is the following:

\[ x_{tm+h} = \mu+\sum_{j=0}^{p_Y}\mu_jy_{t-j}+\sum_{j=0}^{p_X}\beta_{j}x_{tm-j}+\varepsilon_{t} \]

Forecasting inflation using GDP growth

For demonstration we will use quarterly US GDP and monthly US inflation. We fix the end dates, so that this document would reproduce the same results when newer data points appear in future.

We are fitting a model which forecasts the inflation of the first month of the quarter using previous quarter GDP growth. The frequency aligning is done using function mlsd, which uses date information available from gdpg and infl. These two variables are xts objects.

In our case for the model specification we have \(h=1\), \(p_Y = 3\) and \(p_X = 8\). This means that we are using 3 previous quarters of GDP growth and 9 months of inflation data.

The package midasr uses convention that the low frequency variable is observed at the end of the low frequency period, so the high frequency values at the current low frequency period are always lagged. The first month of the quarter is then 2 high frequency lags “behind”.

All model specifications in midasr package assumes that the left hand side variable is observed at the low frequency period \(t\). For \(h=1\) the left hand side is observed at low frequency period \(t+1\), so to specify the model in midasr package we need to lag all the variables by one low frequency period, or 3 high frequency periods (one quarter is equal to 3 months).

Finally we arrive to the following specification:

mr <- midas_r(mlsd(infl,2,gdpg)~mlsd(gdpg, 1:3, gdpg)+mlsd(infl,3+0:8, gdpg), data=list(gdpg=gdpg, infl=infl), start = NULL)

mr

MIDAS regression model with "numeric" data:

Start = 56, End = 302

model: mlsd(infl, 2, gdpg) ~ mlsd(gdpg, 1:3, gdpg) + mlsd(infl, 3 + 0:8, gdpg)

(Intercept) gdpg1 gdpg2 gdpg3 infl1 infl2

-0.03919 0.02315 0.03041 0.06282 1.27659 -0.27883

infl3 infl4 infl5 infl6 infl7 infl8

-0.19871 0.22796 -0.02450 -0.09063 0.22257 -0.13683

infl9

-0.03304

Function lm was used for fittingLet us inspect what time series form the part of the model:

mr$model[nrow(mr$model)-(3:0), ] y (Intercept) mlsd(gdpg, 1:3, gdpg)X.1 mlsd(gdpg, 1:3, gdpg)X.2

300 5.365475 1 3.138917 2.576810

301 6.221869 1 2.008565 3.138917

302 7.479872 1 3.391781 2.008565

303 8.258629 1 1.586818 3.391781

mlsd(gdpg, 1:3, gdpg)X.3 mlsd(infl, 3 + 0:8, gdpg)X.3

300 1.591087 5.391451

301 2.576810 5.390349

302 3.138917 7.036403

303 2.008565 8.542456

mlsd(infl, 3 + 0:8, gdpg)X.4 mlsd(infl, 3 + 0:8, gdpg)X.5

300 4.992707 4.159695

301 5.251272 5.365475

302 6.809003 6.221869

303 7.871064 7.479872

mlsd(infl, 3 + 0:8, gdpg)X.6 mlsd(infl, 3 + 0:8, gdpg)X.7

300 2.619763 1.676215

301 5.391451 4.992707

302 5.390349 5.251272

303 7.036403 6.809003

mlsd(infl, 3 + 0:8, gdpg)X.8 mlsd(infl, 3 + 0:8, gdpg)X.9

300 1.399770 1.362005

301 4.159695 2.619763

302 5.365475 5.391451

303 6.221869 5.390349

mlsd(infl, 3 + 0:8, gdpg)X.10 mlsd(infl, 3 + 0:8, gdpg)X.11

300 1.174536 1.182066

301 1.676215 1.399770

302 4.992707 4.159695

303 5.251272 5.365475Let us inspect the last months of data

infl["2021-10-01/"] CPALTT01USM659N

2021-10-01 6.221869

2021-11-01 6.809003

2021-12-01 7.036403

2022-01-01 7.479872

2022-02-01 7.871064

2022-03-01 8.542456

2022-04-01 8.258629

2022-05-01 8.581512

2022-06-01 9.059758Compare it with the first column of the model matrix and you will see that the values in column y correspond to the values of first month of the quarter, namely the last row contains value for March of 2022, the previous value corresponds to January of 2022 and so on. These values are regressed against previous 12 months of inflation.

Here is the low frequency variable

gdpg["2021-01-01/"] GDP

2021-01-01 2.576810

2021-04-01 3.138917

2021-07-01 2.008565

2021-10-01 3.391781

2022-01-01 1.586818

2022-04-01 1.889125You can see that the values in the last row of the columns mlsd(gdpg, 1:3, gdpg)X.1 to mlsd(gdpg, 1:3, gdpg)X.3 correspond to yearly GDP growth for first quarter of 2022 and the last two quarters of 2021.

Let us inspect model we fit

summary(mr)

MIDAS regression model with "numeric" data:

Start = 56, End = 302

Formula mlsd(infl, 2, gdpg) ~ mlsd(gdpg, 1:3, gdpg) + mlsd(infl, 3 + 0:8, gdpg)

Parameters:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.03919 0.04991 -0.785 0.43308

gdpg1 0.02315 0.01616 1.432 0.15338

gdpg2 0.03041 0.01727 1.761 0.07951 .

gdpg3 0.06282 0.01817 3.456 0.00065 ***

infl1 1.27659 0.07816 16.333 < 2e-16 ***

infl2 -0.27883 0.11661 -2.391 0.01759 *

infl3 -0.19871 0.11981 -1.658 0.09856 .

infl4 0.22796 0.11822 1.928 0.05502 .

infl5 -0.02450 0.13221 -0.185 0.85315

infl6 -0.09063 0.10396 -0.872 0.38424

infl7 0.22257 0.10415 2.137 0.03364 *

infl8 -0.13683 0.12482 -1.096 0.27411

infl9 -0.03304 0.06691 -0.494 0.62196

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.352 on 234 degrees of freedomThe model suggests that the lags of GDP can be useful in forecasting the inflation.

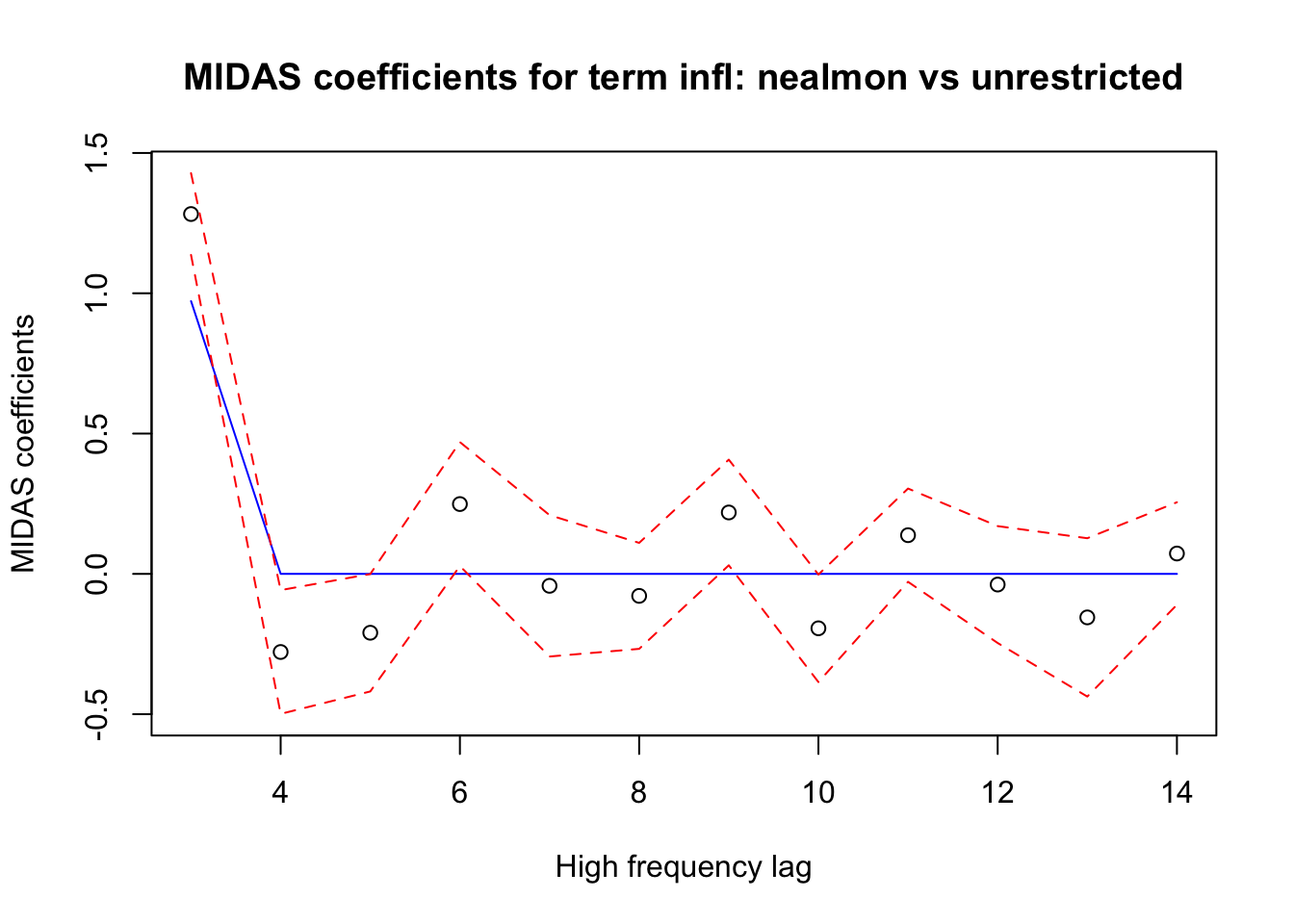

We can try to impose some lag structure on the monthly data:

mr1 <- midas_r(mlsd(infl,2,gdpg)~mlsd(gdpg, 1:3, gdpg)+mlsd(infl,3+0:11, gdpg,nealmon), data=list(gdpg=gdpg, infl=infl), start = list(infl = c(0.1, 0.1)), method = "Nelder-Mead")

mr2 <- update(mr1, method = "BFGS")

mr2

MIDAS regression model with "numeric" data:

Start = 57, End = 302

model: mlsd(infl, 2, gdpg) ~ mlsd(gdpg, 1:3, gdpg) + mlsd(infl, 3 + 0:11, gdpg, nealmon)

(Intercept) gdpg1 gdpg2 gdpg3 infl1 infl2

-0.07238 0.01536 0.04268 0.06299 0.97211 -8.76726

Function optim was used for fittingLet us inspect the fit

summary(mr2)

MIDAS regression model with "numeric" data:

Start = 57, End = 302

Formula mlsd(infl, 2, gdpg) ~ mlsd(gdpg, 1:3, gdpg) + mlsd(infl, 3 + 0:11, gdpg, nealmon)

Parameters:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.07238 0.05187 -1.395 0.1642

gdpg1 0.01536 0.01785 0.861 0.3904

gdpg2 0.04268 0.01729 2.469 0.0142 *

gdpg3 0.06299 0.02093 3.009 0.0029 **

infl1 0.97211 0.01146 84.844 <2e-16 ***

infl2 -8.76726 603.10547 -0.015 0.9884

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.3758 on 240 degrees of freedomThe fit is slightly worse because the restriction is not very good. As can be seen from the coefficients:

plot_midas_coef(mr2)

Frequency aliging with mls

We can align frequencies manually. For that we need to align the start and beginning of the times series and padd high frequency data with NAs. The inflation data ends at June, 2022. The gdp data ends at second quarter of 2022. So in this case we have a full quarter of the high frequency data, which means that no padding is necessary.

infl1 <- infl["1960-01-01/2022-06-01"]

gdpgp1 <- gdpg["1960-01-01/2022-04-01"]

infl2 <- ts(c(as.numeric(infl1)), start=c(1960,1), frequency = 12)

gdpg2 <- ts(as.numeric(gdpgp1), start=c(1960,1), frequency = 4)Let us fit the same model with aligned data.

mra <- midas_r(mls(infl,2,3)~mls(gdpg, 1:3, 1)+mls(infl,3+0:11, 3), data=list(gdpg=gdpg2, infl=infl2), start = NULL)

mra

MIDAS regression model with "numeric" data:

Start = 5, End = 250

model: mls(infl, 2, 3) ~ mls(gdpg, 1:3, 1) + mls(infl, 3 + 0:11, 3)

(Intercept) gdpg1 gdpg2 gdpg3 infl1 infl2

-0.03025 0.02397 0.03639 0.04949 1.28237 -0.27839

infl3 infl4 infl5 infl6 infl7 infl8

-0.20976 0.24882 -0.04254 -0.07836 0.21885 -0.19394

infl9 infl10 infl11 infl12

0.13788 -0.03804 -0.15507 0.07258

Function lm was used for fittingThe model fit is the same. We can check that by comparing the coefficients:

sum(abs(coef(mr)-coef(mra)))Warning in coef(mr) - coef(mra): longer object length is not a multiple of

shorter object length[1] 0.5507905Forecasting

Let us use the model for forecasting. First let us reestimate model with the data up to first quarter of the 2022.

infl_h <- infl["/2022-03-01"]

gdpg_h <- gdpg["/2022-01-01"]

mrh <- update(mr, data = list(infl = infl_h, gdpg = gdpg_h))Check whether the frequency aligning worked as expected:

mrh$model[nrow(mrh$model),1:6] y (Intercept)

7.479872 1.000000

mlsd(gdpg, 1:3, gdpg)X.1 mlsd(gdpg, 1:3, gdpg)X.2

3.391781 2.008565

mlsd(gdpg, 1:3, gdpg)X.3 mlsd(infl, 3 + 0:8, gdpg)X.3

3.138917 7.036403 To forecast the inflation value for April of 2022 (first month of the second quarter of 2022) we cannot use the forecast function of package midasr, because it currently does not support any transformations of left hand side variable. But we can use function predict, which simply fits the supplied right hand side data. So to get the forecast we pass the full data.

pr <- predict(mrh, newdata = list(gdpg = gdpg, infl = infl))Since the full data has additional low frequency lag, the forecast will be the last predicted value. We can check that the predictions for historic data coincide with fitted values of the model. Let us check the last four predictions.

cbind(pr[length(pr)-(5:1)],mrh$fitted.values[length(mrh$fitted.values)-(4:0)]) [,1] [,2]

[1,] 1.123523 1.123523

[2,] 3.451415 3.451415

[3,] 5.418586 5.418586

[4,] 5.667616 5.667616

[5,] 7.142025 7.142025We can compare the model forecast with the actual value

c(pr[length(pr)], infl["2022-04-01/2022-04-01"])[1] 8.648260 8.258629We can see that the model forecasted higher inflation.

Forecasting full quarter

To forecast other months we need to specify a model for each month. The only change is the left hand side variable. We will fit the models with the data with last quarter removed.

mrh_2 <- update(mrh, formula = mlsd(infl, 1, gdpg)~.)

mrh_3 <- update(mrh, formula = mlsd(infl, 0, gdpg)~.)Let us inspect the last rows of the model matrices used to check that frequency alignment works as expected.

mrh_2$model[nrow(mrh_2$model),1:6] y (Intercept)

7.871064 1.000000

mlsd(gdpg, 1:3, gdpg)X.1 mlsd(gdpg, 1:3, gdpg)X.2

3.391781 2.008565

mlsd(gdpg, 1:3, gdpg)X.3 mlsd(infl, 3 + 0:8, gdpg)X.3

3.138917 7.036403 mrh_3$model[nrow(mrh_3$model),1:6] y (Intercept)

8.542456 1.000000

mlsd(gdpg, 1:3, gdpg)X.1 mlsd(gdpg, 1:3, gdpg)X.2

3.391781 2.008565

mlsd(gdpg, 1:3, gdpg)X.3 mlsd(infl, 3 + 0:8, gdpg)X.3

3.138917 7.036403 The right hand side remains the same and the left hand side have values for the respective second and third months of the first quarter of 2022.

Let us forecast the full quarter and compare with the actual values.

pr2 <- predict(mrh_2, newdata = list(gdpg = gdpg, infl = infl))

pr3 <- predict(mrh_3, newdata = list(gdpg = gdpg, infl = infl))

q2f <- c(tail(pr, n = 1), tail(pr2, n = 1 ), tail(pr3, n = 1))

cbind(q2f, infl["2022-04-01/2022-06-01"]) q2f CPALTT01USM659N

2022-04-01 8.648260 8.258629

2022-05-01 8.682332 8.581512

2022-06-01 8.595526 9.059758Forecasting the next quarter

Since the we use only the previous low frequency period in the specification we can forecast the inflation for the months for which we do not have the data, i.e. the months of July to September of 2022. To do that we only need to extend the historic data time series with NAs for the next quarter.

infl_q3 <- xts(c(NA,NA,NA), order.by = ymd("2022-07-01","2022-08-01","2022-09-01"))

gdpg_q3 <- xts(NA, order.by = ymd("2022-07-01"))

infl_f1 <- c(infl,infl_q3)

gdpg_f1 <- c(gdpg,gdpg_q3)Let us update the specifications with full historic data and then do the forecast.

mrh_f2 <- update(mrh_2, data = list(infl = infl, gdpg = gdpg))

mrh_f3 <- update(mrh_3, data = list(infl = infl, gdpg = gdpg))

pr_jul <- predict(mr, newdata = list(infl = infl_f1, gdpg = gdpg_f1))

pr_aug <- predict(mrh_f2, newdata = list(infl = infl_f1, gdpg = gdpg_f1))

pr_sep <- predict(mrh_f3, newdata = list(infl = infl_f1, gdpg = gdpg_f1))

pr_q3 <- c(tail(pr_jul, n = 1), tail(pr_aug, n = 1), tail(pr_sep, n = 1))

xts(pr_q3, order.by = ymd(c("2022-07-01","2022-08-01","2022-09-01"))) [,1]

2022-07-01 9.303091

2022-08-01 9.360826

2022-09-01 9.343012